Introduction

Only nine states do not levy an income tax, and Florida is one of them. States like Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming are not included. (New Hampshire does not include tax salaries but does tax investment earnings and dividends.) This means that you are exempt from filing a state income tax return unless you operate a business or receive income from rental properties. There is no state income tax in Florida nor a state or local tax on estates or inheritances. However, it does impose a wide range of sales and property taxes, some of which are pretty hefty. Despite this, the Tax Foundation, an independent organisation dedicated to unbiased research and education, has consistently classified the state's overall tax burden as one of the lowest in the country.

Who Has To File Florida State Taxes?

You may be required to file a state income tax return if you have taxable income from a business, rental property, or farm. You can contact the Florida Department of Revenue if you have any questions about your tax filing status or eligibility.

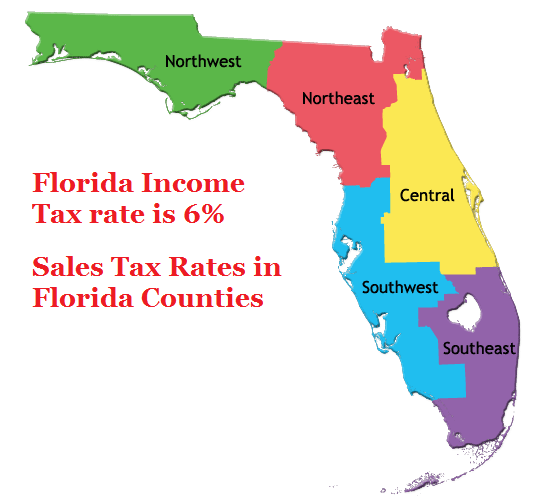

Florida Income Taxes

It's tax season in Florida, so residents can finally relax after a long winter of federal paperwork and enjoy the state's beautiful weather. There is no need to file a state income tax return if you are not required to pay income tax to the state. This eliminates the need to learn about various state-specific tax breaks. High-income earners have a compelling reason to relocate their skills to South Beach.

Florida Sales Tax

Statewide, Floridians must pay a 6% sales tax. Florida has a state sales tax of 6%, with certain counties adding 1.5%. This implies that the effective rate charged in Florida might be as high as 7.5%. The Tax Foundation ranks Florida as having the 23rd highest average sales tax rate in the United States at 7.01 percent. In Florida, municipal governments do not impose a local sales tax. Listed here are the total sales tax rates for all Florida counties, including state and municipal taxes.

Registering For Collecting And Reversing Taxes

Obtaining a tax identification number from the Florida Department of Revenue is necessary to launch a business in the state. Department of Revenue form DR-15 must be submitted monthly or quarterly. Details such as total sales, exempt amount, and tax due will be displayed on this form. Even if there were no sales during the reporting period, you must fill out this form. Penalties may be incurred for failure to submit DR-15.

Property Tax Exemptions

If you own property in Florida, you may be eligible for one of the numerous exemptions that will lower your tax burden. There is a homestead exemption of up to $50,000 and additional exemptions for people over 65 and people with disabilities.

There are four types of exemptions available to veterans, and a $500 exemption is available to widows and widowers who have not remarried and were not divorced at the time of the death of their spouse. Blind homeowners can also receive a $500 tax break.

Other Things To Know About Florida State Taxes

Florida is one of the few states that does not impose an income tax. However, at 8.9 percent, its share of total federal taxes places it 34th among the states. It's possible that you don't have to file a tax return, but the government still has plenty of other ways to get its hands on your money.

More specifically, business owners in Florida may be required to submit a state income tax return. Its business tax rate of 4.5 percent ranks fourth lowest among all states. The Florida Department of Revenue now offers an online tax filing option. It is also the place to go for information on any state taxes.

How To Get A Florida Tax Permit

The Florida Department of Revenue prefers online registration; however, paper registrations can also be mailed in. Create an account and apply for a tax ID certificate online. You'll need the date your business was registered on sunbiz.org, its legal name and address, its Employer Identification Number (EIN) received from the IRS website and the terms and SSNs of its owners.

State Corporate Taxes

In the past, Florida lowered its corporate income/franchise tax rate from 4.458% to 3.535% for tax years beginning on or after January 1, 2021 and ending on or before January 1, 2022. For tax years beginning on or after January 1, 2022, however, the corporate income tax rate has once again increased to 5.5% (where it was previous in 2019).

Conclusion:

There is a cap on annual property value increases of either 3% of the prior year's assessment or the CPI, whichever is lower. A homestead exemption of up to $50,000 is available, and people over the age of 65 and those with disabilities can qualify for property tax breaks. Florida has reinstated a 5.5% corporate income tax rate, effective January 1, 2022. There are no state income, estate, or inheritance taxes in Florida.