Introduction

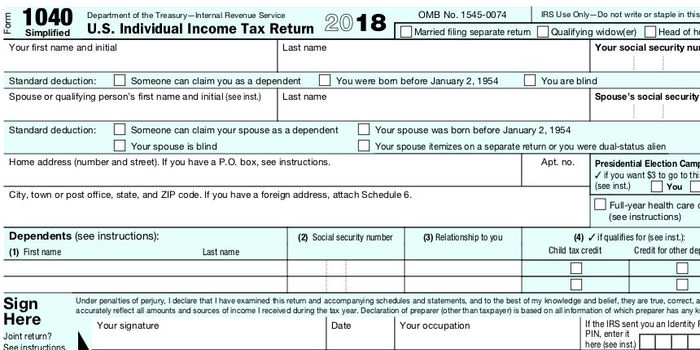

Want to know what is form 1040? By law, you must submit your Form 1040 to the IRS by April 15 every year. If your income is above the threshold, you must file an income tax return with the Internal Revenue Service (businesses have different forms to report their profits). Following the enactment of the Tax Cuts and Jobs Act (TCJA), the Internal Revenue Service (IRS) completely revised Form 1040 for the 2018 tax year and looked into methods to make the form easier to fill. The new, more concise 1040 was promoted as streamlining the dissemination of future tax-law changes and lowering the options available to taxpayers. The updated Form 1040 consists of two pages and can be downloaded from the IRS website. The 1040 tax return can be filed either by mail or electronically.

Information such as a taxpayer's name, address, Social Security number (it's conceivable that some information about their spouse is also required) and the number of dependents is requested by the Internal Revenue Service on Form 1040. The taxpayer is also asked if they have health insurance for the entire year and if they would like to donate $3 to the presidential campaign.

The new Form 1040 uses the "building block" concept, as described by the Internal Revenue Service, which allows filers to include only the relevant schedules. In addition to the long-standing schedules for things like company income or loss, specific individuals may now be required to file one or more of six new supplemental schedules along with their 1040 depending on whether they are claiming tax credits or owing additional taxes. These people could have to attach one of the new schedules on their 1040.

Various Form 1040 Varieties

Depending on their personal situations, some taxpayers will have to submit a variant of Form 1040 other than the standard one. What you can do is pick from the options below.

Instructions for Form 1040-NR

Any number of non-resident aliens, or their legal representatives, need to fill out and submit this form—those who make a living through trade in the United States. Decedents' representatives must submit Form 1040-NR—those who were charged with filing a Form 1040-NR on behalf of a trust or estate. The 1040-SS and the 1040-PR are both forms created by the IRS. If you have net self-employment income but are not required to file Form 1040 because you live in American Samoa, Guam, or Puerto Rico, utilise Form 1040-SS. IRS Form 1040-PR is the Spanish version of Form 1040-SS.

Instructions for Form 1040-ES

This form is to be used to determine your estimated tax payment for the quarter and report it to the IRS. The anticipated tax is due on non-wages income such as interest, dividends, and rent that is not subject to withholding. Social Security, pension, and unemployment insurance all have taxable components that could be included here.

Form 1040-V

If the taxpayer has a balance due on the "Amount you owe" line of their 1040 or 1040-NR, they must attach this statement to their payment.

Form 1040-X

To correct mistakes or omissions on a previously filed 1040, utilise Form 1040-X.

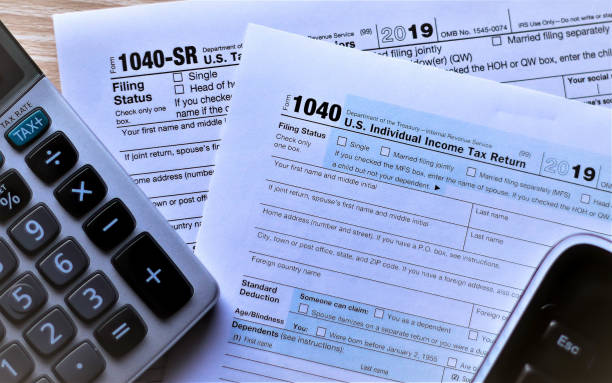

Federal Tax Return, Short Form (Form 1040-SR)

In 2019, the IRS issued Form 1040-SR, tailored to retirees' needs. The standard deduction chart has been revised by increasing the font size and removing colouring to account for the increased standard deduction for seniors (shaded areas can be challenging to read). Seniors who file their taxes electronically won't see any changes, but those who prefer paper will.

Who Needs to File Form 1040?

Form 1040 or one of the variants listed above must be filed by any U.S. citizen who wishes to or is compelled to submit a federal income tax return. There are three primary considerations for deciding whether or not a person must file.

The IRS first mandates tax filing for individuals with a certain threshold of annual gross income. The amount of taxable income above which taxes must be paid varies depending on the taxpayer's age and filing status. The following table details the income limits for those younger than 65 years old, the thresholds for those 65 or older, and the criteria for married couples if either spouse is 65 or older.

Conclusion

Form 1040 is the starting point and final destination for any tax return filed by a resident of the United States. Ultimately, a taxpayer's financial statements will be entered into this tax form, and all accompanying tax schedules will branch out from this form. If you're obligated to file taxes, regardless of your filing status or income level, you must fill out Form 1040.